Long Term Capital Gain Tax on Property: Understanding Exemptions and Calculation

Learn about long-term capital gain tax on property and how to calculate it. Explore the exemptions available under sections 54, 54EC, and 54F for reinvesting in house properties or specific bonds. Understand the rules and conditions to optimize your tax liability on property sales.

Introduction: When it comes to property sales, understanding the long-term capital gain tax is crucial. In this guide, we will delve into the intricacies of long-term capital gain tax on property and provide insights into the exemptions available under sections 54, 54EC, and 54F. By optimizing your tax liability, you can make the most of your property sales.

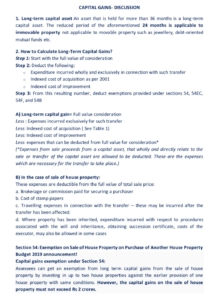

Definition of Long-term Capital Asset and Duration: A long-term capital asset refers to property held for more than 36 months, except for immovable assets, where the period is reduced to 24 months. This reduced period does not apply to movable assets like jewelry or debt-oriented mutual funds.

How to Calculate Long-Term Capital Gains on Property: To calculate long-term capital gains, follow these steps: a. Start with the full value of consideration received from the sale. b. Deduct the following:

- Expenses incurred exclusively for the transfer.

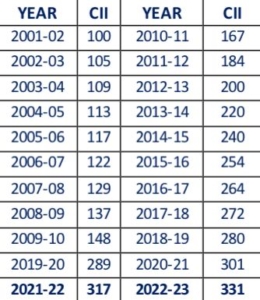

- Indexed cost of acquisition as per 2001.

- Indexed cost of improvement. c. Deduct any applicable exemptions under sections 54, 54EC, and 54F.

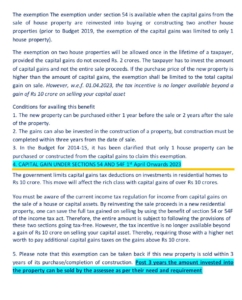

Exemptions under Section 54: Sale of House Property: Section 54 offers exemptions on the sale of house property. Key points to know include:

- Exemption from long-term capital gains by reinvesting in up to two house properties (previously limited to one).

- Capital gains should not exceed Rs 2 crores.

- Timeframes to invest in new properties: one year before the sale or two years after the sale.

- Tax incentives no longer applicable beyond a gain of Rs 10 crores.

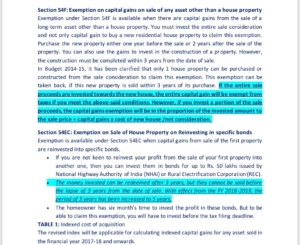

Exemptions under Section 54F: Sale of Assets Other Than House Property: Section 54F provides exemptions for capital gains from the sale of assets other than house property. Important details include:

- Reinvest the entire sale consideration in a new residential house property.

- Purchase the new property one year before the sale or two years after the sale.

- Construction of the property must be completed within three years from the sale.

- Selling the new property within three years may lead to the withdrawal of exemptions.

Exemptions under Section 54EC: Reinvestment in Specific Bonds: Section 54EC allows exemptions when capital gains from property sales are reinvested in specific bonds. Highlights include:

- Invest in bonds issued by NHAI or REC, up to Rs. 50 lakhs.

- Bonds cannot be sold before the lapse of three years (extended to five years from FY 2018-2019) from the sale.

SOUTHDELHIPRIME SUGGESTS:-

By understanding long-term capital gain tax on property and the available exemptions under sections 54, 54EC, and 54F, you can optimize your tax liability on property sales. Remember to adhere to the specific rules and conditions for each section to enjoy the tax benefits. Consult a tax professional for personalized guidance and make informed decisions regarding your property transactions.

CAPITAL GAINS - DISCUSSION