Understanding Stamp Duty And Registration Charges : Impact of 1% Increase In South Delhi

Learn about stamp duty and registration charges in property transactions. Explore the recent 1% increase in registration cost in South Delhi, its implications for buyers and sellers, and how to navigate the changing real estate landscape.

Property transactions involve various expenses, and two significant components are stamp duty and registration charges. These charges are essential to validate and legalize property transactions. Recently, the government implemented a 1% increase in the registration cost in South Delhi, which has potential implications for both buyers and sellers. In this blog, we will explore stamp duty and registration charges, understand the reasons behind the hike, and discuss its impact on the South Delhi real estate market.

Understanding Stamp Duty and Registration Charges:

-

Stamp Duty: Stamp duty is a tax levied by the government on property transactions to legalize the documents involved, such as sale deeds, agreements, and leases. The rate of stamp duty varies across states and is typically a percentage of the property’s market value or the consideration paid for the property, whichever is higher.

-

Registration Charges: Registration charges are the fees paid to the government for registering the property transaction documents with the local authority. Registration provides legal validity and protection to the property rights of the parties involved in the transaction.

Reasons for the 1% Increase in Registration Cost:

The 1% increase in registration cost in South Delhi is a part of the government’s fiscal measures to boost revenue and address economic challenges. As the real estate sector is a significant contributor to the country’s economy, such measures are taken to meet the fiscal requirements and maintain financial stability.

Implications for Buyers:

-

Increased Acquisition Cost: With the 1% increase in registration cost, property buyers in South Delhi will face higher acquisition costs. This may influence their budgets and property choices, necessitating a reassessment of financial plans.

-

Negotiation Strategies: The higher registration cost might prompt buyers to reconsider their negotiation strategies. Sellers may be open to negotiations on property prices to accommodate the additional expense.

-

Financial Planning: Prospective buyers should conduct thorough financial planning to accommodate the increased registration cost. Researching and comparing property prices will help them make informed decisions.

Implications for Sellers:

-

Adjusting Property Prices: Sellers may need to adjust property prices strategically to attract potential buyers. Competitive pricing and emphasizing value propositions will help maintain market competitiveness.

-

Marketing Strategies: In light of the increased registration cost, sellers should revise their marketing strategies to highlight the unique features and advantages of their properties.

Navigating the Changing Real Estate Landscape:

-

Consult Real Estate Professionals: Seek guidance from experienced real estate agents who have a deep understanding of the South Delhi market. They can provide valuable insights and help you make informed decisions.

-

Legal Documentation: Ensure the accuracy and completeness of legal documents involved in the property transaction. Engaging legal experts can help avoid any potential issues later on.

-

Stay Updated: Keep yourself informed about the latest changes in real estate regulations and market dynamics. Being aware of the developments will empower you to make well-informed decisions.

The 1% increase in registration cost in South Delhi impacts both buyers and sellers in the real estate market. Buyers need to reassess their budgets and negotiation strategies, while sellers should adjust property prices and marketing strategies accordingly. Navigating the changing real estate landscape requires thorough planning, research, and professional guidance to make the most of the opportunities in this prestigious market.

Exciting Updates on Stamp Duty and Registration Charges In Delhi

Stay updated with the latest developments in the real estate sector in Delhi as the city experiences significant changes in stamp duty and registration charges. Here’s a roundup of recent news that you need to know:

- Transfer Duty Increase:

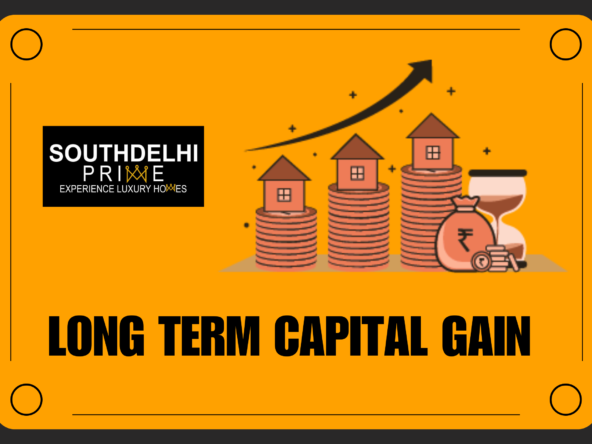

Effective from July 10, 2023, the Municipal Corporation of Delhi has implemented a 1% increase in transfer duty on immovable properties. This increment applies to both females and the third gender, raising the transfer duty from 2% to 3%. For males and other entities, the transfer duty has surged from 3% to 4%. The new charges are applicable immediately across all sub-registrar offices in Delhi.

It’s important to note that the increase in transfer duty is applicable only when the value of the instrument to be registered exceeds Rs 25 Lakhs. For instruments valued up to Rs 25 Lakhs, the transfer duty remains unchanged.

The increase in transfer duty fees may impact home buyers, as it adds to the overall cost of stamp duty, registration charges, and GST on property transactions.

- Surge in Stamp and Registration Fee Collection:

According to recent data reported by TOI, the Delhi government’s revenue from stamp and document registration has remarkably increased over the last nine years. In the fiscal year 2013-14, the revenue amounted to around Rs 2,308.2 crore, whereas in 2022-23, it reached an impressive Rs 5,736.7 crore. The revenue comprises stamp duty revenue of Rs. 4,668.7 crores, registration fees of Rs. 889.7 crores, and court fees of Rs. 178.2 crores for online cases heard in revenue courts.

Officials stated that the collection under the stamp and registration program grew by approximately 16% in the most recent fiscal year compared to the previous one, indicating a positive trend in revenue generation.

- Simplified Property Registration:

In a significant move to ease property registration in Delhi, the capital is set to be combined under one single district. This new system will enable individuals to register properties from any sub-registrar’s office, making the process much more convenient and accessible for property buyers and sellers.

The Online Complaint Filing Management System (OCIMS) will also be introduced, allowing people to file complaints electronically, reducing the need for physical presence and minimizing human interface in the registration process. The system will promote transparency and help curb corruption, ensuring a smoother and more efficient property registration experience.

With these exciting updates, it’s crucial to stay informed and adapt to the evolving real estate landscape in Delhi. Whether you’re a buyer or seller, being up-to-date with the latest changes in stamp duty and registration charges can help you make informed decisions and navigate the property market with confidence.

MCD NOTIFICATION (TRANSFER DUTY)