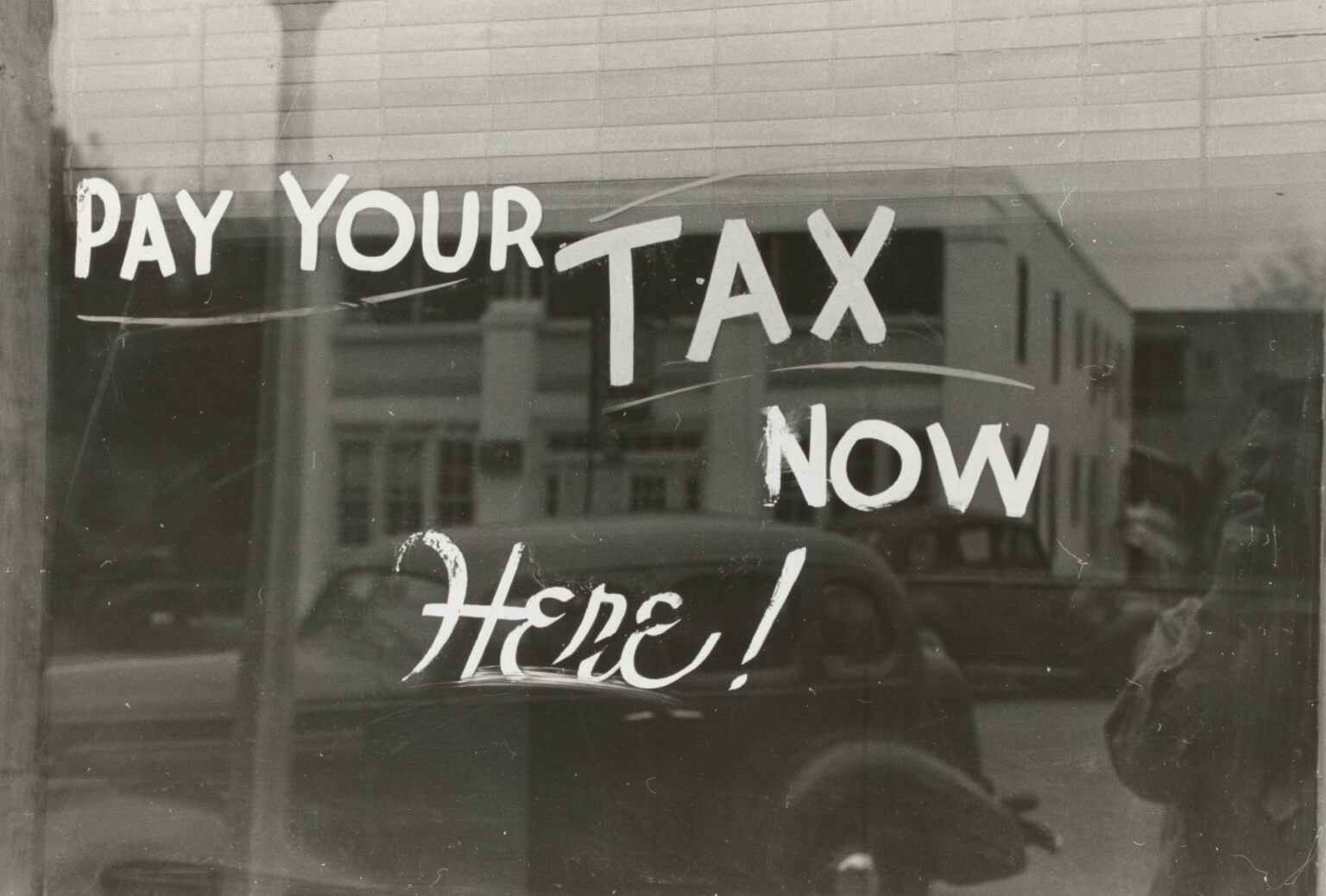

If you own an MCD property in South Delhi, then you will have to pay property tax online to the Municipal Corporation of Delhi (MCD). All the South Delhi properties including the vacant ones which come under the purview of the body will be charged with the SMCD property tax. MCD is responsible for collecting property taxes from residents. Taxes are collected annually and the MCD sets a deadline. Usually, people pay their tax by the end of the financial year (March). But due to COVID lockdown at the same time, this year estimated loss is Rs. 180crore.

In the last financial year (2019-20), the north corporation earned Rs. 1,118 crore in property tax, which was almost 45% of its total income of Rs. 2,485 crore. Officials said 4.68 lakh houses have already been enrolled in the UPIC (Unique Property Identification Card) system and brought under the tax net.

MCD unveiled a new interface on its portal for citizens to file their property tax

This has been aimed at earning a lot more residents for filing their taxes online. This comes in during a time when people are unable to step out of their homes because of the lockdown amidst COVID.

The new portal is designed and operated by a government agency, National Informatics Centre (NIC).

- It is a user-friendly feature.

- The entire data is now cloud-based.

- Visitors can now file their MCD property tax for previous years.

- Also can see their entire payment history over the years on the new portal.

How to Pay MCD Property Tax online?

Given below are the steps you will have to follow to pay the MCD Property Tax online as per new guidelines:

- Visit the official website of MCD select the required MCD – South Delhi MCD, North Delhi MCD, or the East Delhi MCD.

- Click on ‘online services’ button on the top

- Tick the box ‘Property Tax’

- Fill your registered ‘Mobile Number’ to receive OTP or sign up to register your number

- Choose any one of the options – Search Property on UPIC, Register New Property, Apply for New UPICor Download Mutation Certificate

- If you are filing the property tax for the first time or registering the new property with no UPIC, then click on the option ‘Apply for new UPIC’.

- Enter the necessary details like ownership type, property category, old UPIC, mutation number, and other property details like an award, zone, and address. Click on ‘Submit’.

- The property id will be sent to your registered mobile number. You can use the property id to file your property tax in the future.

- Keep your pan number, property ID, and sale deed handy as you will be required to upload it.

- You will be directed to a separate page containing the details of your property ownership.

- Enter the details of your property and automatically calculate the tax payable. Click on ‘Submit.

- You can pay the property tax online either by credit/debit card or by net banking.

- Once the tax has been paid, click on ‘generate challan’. Download.

- And it’s done!

feedback from Clients

- There are currently few glitches on this site like OTP delay, timeout while uploading documents, etc so be patient and keep trying!

- It will ask you to register yourself & your mobile number. Keep your pan number property ID handy & pdf file of your sale deed ready as you will be required to upload it.

- We paid last Friday. Please go to mcdonline.nic.in You will have to fill in details of your property and will have to upload ownership proof. Not difficult once you understand.

- Once or twice, keep trying

- During the working hours site is usually slow so the best time is to try it early morning.

How to calculate MCD property tax?

Property Tax = Annual Value * Rate of Tax

Annual Value = Unit area value per square meter x unit area of property x age factor x use factor x structure factor x occupancy factor

Rate of Tax = MCD publishes the rate of tax for A-H categories every year. You can find the applicable rate of tax on the official website of MCD Property Tax.

- Unit area value: This is the value per square meter assigned for the built-up area of the property

- Unit area of property: The built-up area not in the carpet area per square meter

- Age factor: Newer properties are levied higher tax as compared to old ones. The age factor is based on the age of the property, where the value of this factor ranges from 0.5 to 1.

- Use factor: Residential properties are levied lower tax as compared to the non-residential properties. The value of the factor assigned is 1.

- Structure factor: RCC constructions are levied higher tax in comparison to low-value constructions.

- Occupancy factor: Properties that are rented out are levied higher tax as compared to the self-occupied ones

Exemption for MCD Property Tax

Given below are the bodies/individual who is exempted from the payment of property tax:

- Vacant land or buildings used as a place of worship, public burial, heritage land, or used for charitable purposes by anybody or individual.

- Agricultural land or building.

- Land or building vested in the corporation.

- Property owned by ex-servicemen or widow of a person martyred in war. The property should only be used as a self-residence and no portion of it is let out.

- Properties martyred on paramilitary or police duty.

- Property owned by a South MCD employee who is handicapped but fully on duty.

- Any sportsperson who has won awards for any international games.

Happy tax filing to you!

For all your south Delhi floors, bungalows, flats, apartment and home needs to contact us. We have the best team for Selling, Buying, Leasing, Renting,Collaboration and Joint ventures in south Delhi posh colonies like Saket, Jor Bagh, Anand Niketan, Shanti Niketan, South extension, Greater Kailash.

Southdelhiprime.com a Digital Venture of SanD Advisory Pvt Ltd. is a boutique real estate advisory & transaction company, having advised the who’s who of South Delhi on their real estate assets. We have special expertise in high value transactions & dispositions in South & Central Delhi. With over 500+ clients, SanD has done transactions worth millions. DoctorProperty.in, our online expert will respond to some of the common questions we’re receiving regarding buying a house during this pandemic.

SanD Recent MEDIA COVERAGE:

Articles on SOUTH DELHI Real Estate Market

(1) Moneycontrol.com:

http://www.moneycontrol.com/

(2) Hindustan Times:

https://www.hindustantimes.

(3) Hindustan Times:

http://www.hindustantimes.com/

(4) NDTV Realty Show:

Brainstorming Session with Mr. Sanjaya Gupta, MD, PNB Housing

https://www.youtube.com/watch?

(5) Follow us on:

BUY ReAL ESTATE BY ReSeARCH in

SOUTH DELHI Real Estate Market

http://www.slideshare.net/